Are you trying to find the best pet insurance for your Australian Retriever?

You’ve come to the right place! I’ve researched options across price ranges to help you find the best plan for your needs.

Here are some important things to know about pet insurance policies:

- Most pet insurance is reimbursement-based. That means you pay your vet up-front, then submit a claim to the insurance company to be reimbursed.

- Pet insurance doesn’t pay for everything. Although it depends on the plan, most companies reimburse a percentage of vet bills, not the entire thing. Sometimes, medications and prescription food are also covered. There can also be exclusions to coverage. For example, regular dental cleanings, checkups or routine care, and grooming are usually not covered.

- There are two main types of pet insurance plans – Accident-Only Plans and Major Medical Plans.

-

- Accident-only insurance covers accidental or acute injuries. For example, a dog injured by a car or attacked by another dog.

-

- Major Medical insurance covers regular care of your pet, including vaccines, surgeries, x-rays, and other health visits. Sometimes, preventative care is included for an increased cost, but most of the time, it’s excluded. Preventative care includes annual checkups, dental cleaning, nail trims, and other routine visits.

- Pet insurance coverage costs are based on your individual dog. Your pet’s age, weight, health history, and breed are all important in determining your costs. I’ve included links for each company so you can get an accurate quote for your Australian Retriever!

7 Best Pet Insurance Companies for Australian Retrievers:

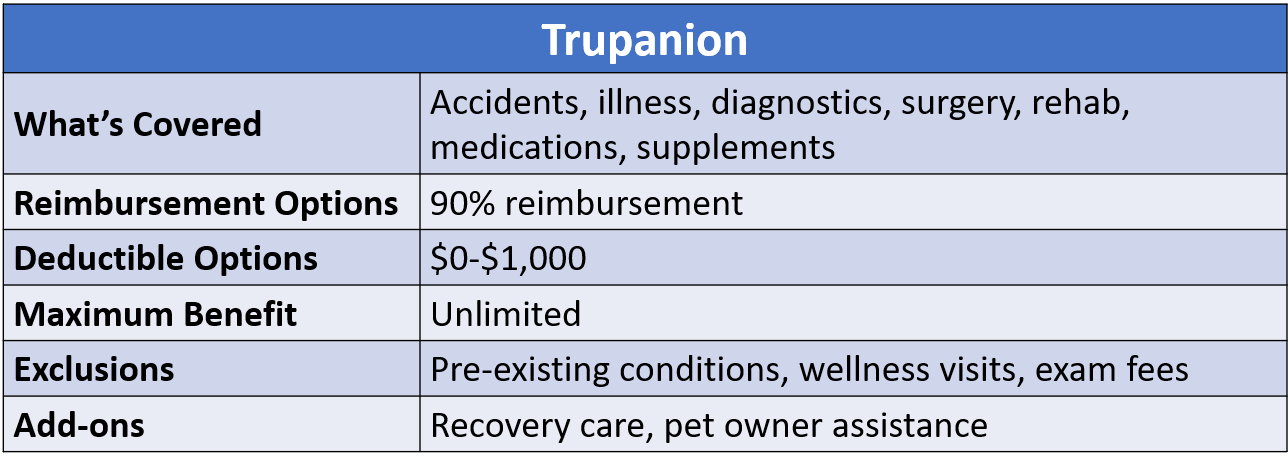

#1. Trupanion

Trupanion offers some of the highest-rated pet insurance for Australian Retrievers.

Their plan reimburses 90% of covered bills, including surgery, prescription medication, and more! The plans are more expensive than most on the list, but in this case, you get added benefits to go along with the price tag. For example, even supplements are covered as long as they are purchased through your veterinarian!

You can choose your deductible from $0-$1,000, which will also adjust your monthly price. Additionally, Trupanion offers add-on packages for recovery (coverage for chiropractic, physical therapy, etc.) and pet owner assistance, which helps cover the costs of boarding, end-of-life care, and liability.

Trupanion’s waiting periods are five days for injury and 30 days for illness. A waiting period is the amount of time after you purchase coverage that you need to wait before the coverage will apply. For example, if you purchase an insurance policy on a Monday, you won’t have coverage for a car accident or similar injuries until the following Saturday.

Positives:

- All plans have a 90% reimbursement, regardless of your dog’s size, age, or health.

- The deductible is customizable to adjust the price.

- Added coverages include supplements and prescription medication.

Negatives:

- PRICE – One of the most expensive options available.

- Routine checkups and exam fees are excluded.

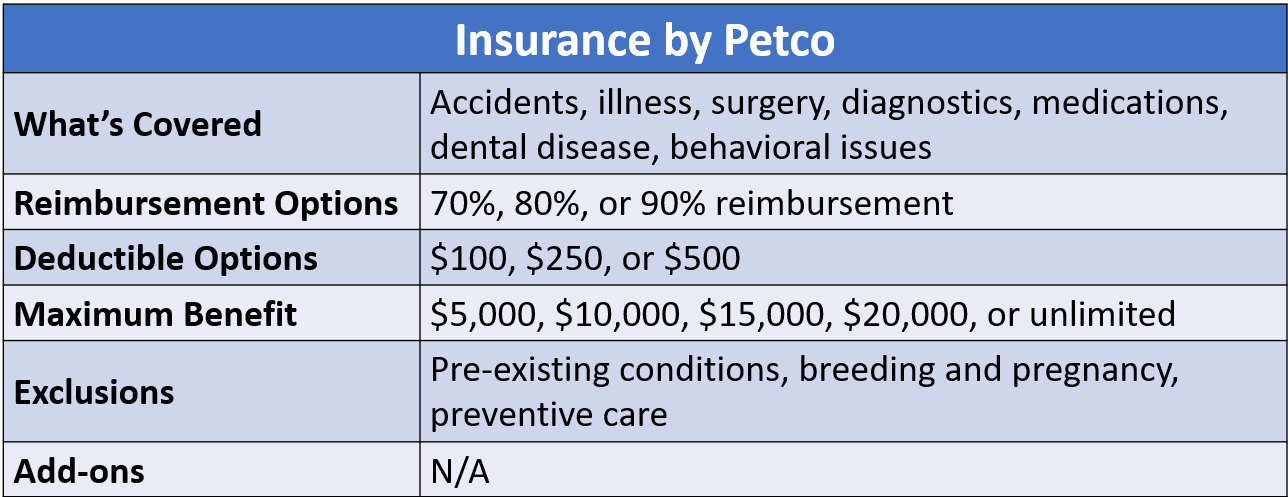

#2. PetCo Insurance

Pet insurance for Australian Retrievers offered by Petco is a flexible, customizable plan with great coverage for any pet. Petco offers a choice of the coverage amount, deductible, and reimbursement, so you can be assured that you’re getting the plan you want! It’s a great balance of choice without a bunch of confusing add-ons that you may not need.

In addition, Petco’s plan covers quite a bit that other plans don’t, like behavioral issues, dental disease, and medications. They have a 15-day waiting period for all coverage, regardless of whether it’s an accident or illness.

Positives:

- Petco is a trusted name in pet products, and its insurance plan is a great option.

- Coverage for things like dental disease and behavior issues adds value.

- Adjustable deductible, coverage limit, and reimbursement amount allow you to adjust your price.

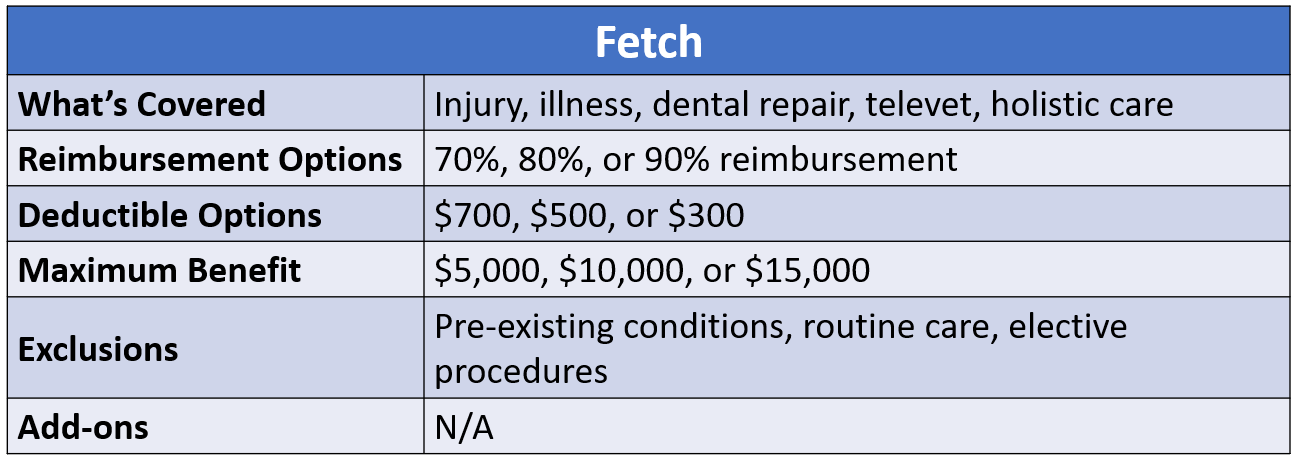

#3. Fetch

Fetch offers the most comprehensive pet insurance for Australian Retrievers.

Their plans include nearly any treatment you can think of, including holistic care like acupuncture and chiropractic care. However, like other companies, Fetch doesn’t cover dental cleanings or regular checkups.

Fetch’s waiting periods are 15 days for injury and illness and six months for treatment of hip and knee injuries. If you want an insurance policy that covers nearly any treatment for your pet, Fetch is a great choice!

Positives:

- Holistic treatments, including chiropractic and acupuncture, are covered.

- Deductible and coverage options are customizable to adjust the price.

Negatives:

- Fetch plans are some of the most expensive available.

- Routine checkups and dental cleanings are excluded.

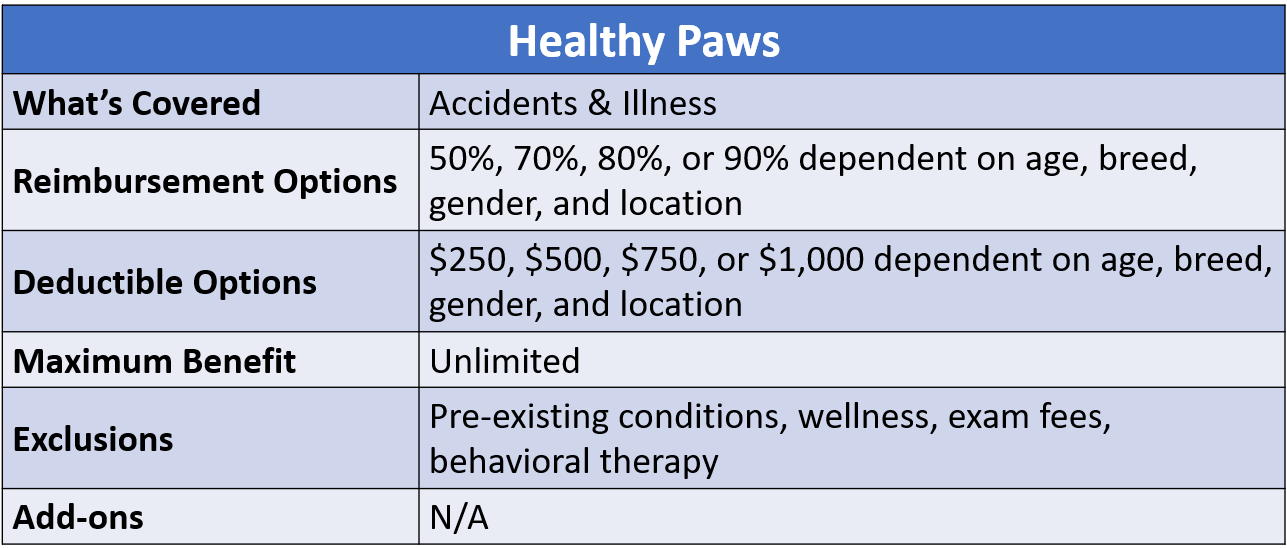

#4. Healthy Paws

If you want straightforward pet insurance for your Australian Retriever without additional add-ons or bells and whistles, Healthy Paws is the plan for you. This insurance plan doesn’t have any customizable features. Instead, you simply enter your dog’s information, and you’re given a quote based on that info. You don’t need to worry about adjusting the deductible or reimbursement because every plan is tailored to your specific dog.

The inability to change plan coverages helps make Healthy Paws less confusing than other insurance companies, but this feature can be a drawback for others that want to adjust something. Unfortunately, there isn’t much you can do to change the coverage if you don’t like the option.

Healthy Paws has a 15-day waiting period for all coverage except hip dysplasia. The waiting period for hip dysplasia is 12 months, and coverage is available for pets under six years old (where applicable).

Positives:

- A single plan type with no add-ons makes signup easy.

Negatives:

- The lack of options means the plan might not work for you and your dog’s needs.

#5. Lemonade

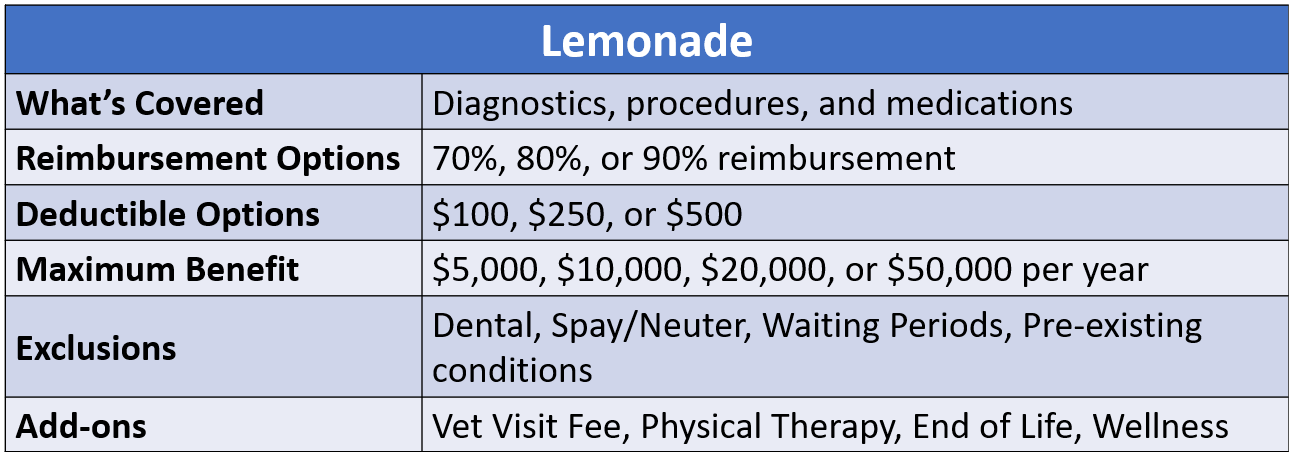

Lemonade Pet Insurance for Australian Retrievers offers one of the most customizable products we found. Everything from your deductible to the procedures covered can be customized to fit you and your pet!

The waiting periods are relatively short: two days for accidents, 14 days for illness, and six months for cruciate ligament injury. Cruciate ligaments are ones that connect the leg bones, most often associated with hip and knee issues.

Their basic plan covers diagnosis, procedures, and medications for accidents and acute illnesses like cancer or infections. In addition, you can add on services like wellness plans that cover checkups, physical therapy, and even end-of-life care. I would recommend Lemonade for its versatility, whether you have a puppy or a senior dog.

Positives:

- The plans and add-ons are customizable, so you can get exactly what you want without paying for things you don’t need.

Negatives:

- No 24-hour vet line, coverage for prescription food, or microchipping.

#6. Pets Best

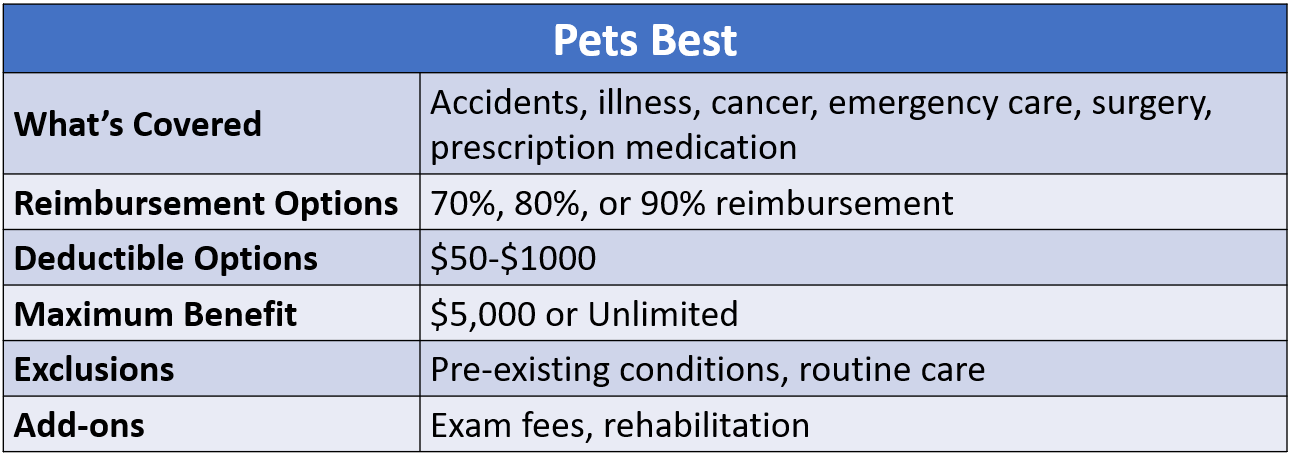

If you want pet insurance for your Australian Retriever that’s straightforward and easy to understand, consider Pets Best.

They offer three plan levels that cover accidents, injuries, and illnesses, and additional coverage can be added for a higher premium. The quote is easy to understand and customize, and it only takes a few minutes to get. Additionally, Pets Best offers a direct pay service to vets, so you don’t have to wait for reimbursement.

The waiting period for coverage isn’t advertised on the Pets Best website, so you will need to check your individual quote for information on waiting periods.

One of my favorite features of the Pets Best plans is that you can add coverage for rehabilitation, which is great for maintaining your dog’s health after surgery!

Positives:

- The quoting process is easy to understand and simple to customize.

- Add-on coverage for rehab, exam fees, and chiropractic care is available.

- If your vet accepts payment from Pets Best, they can pay directly, so you don’t have to be reimbursed.

Negatives:

- Some things are never covered, like dental cleaning and nail trimming.

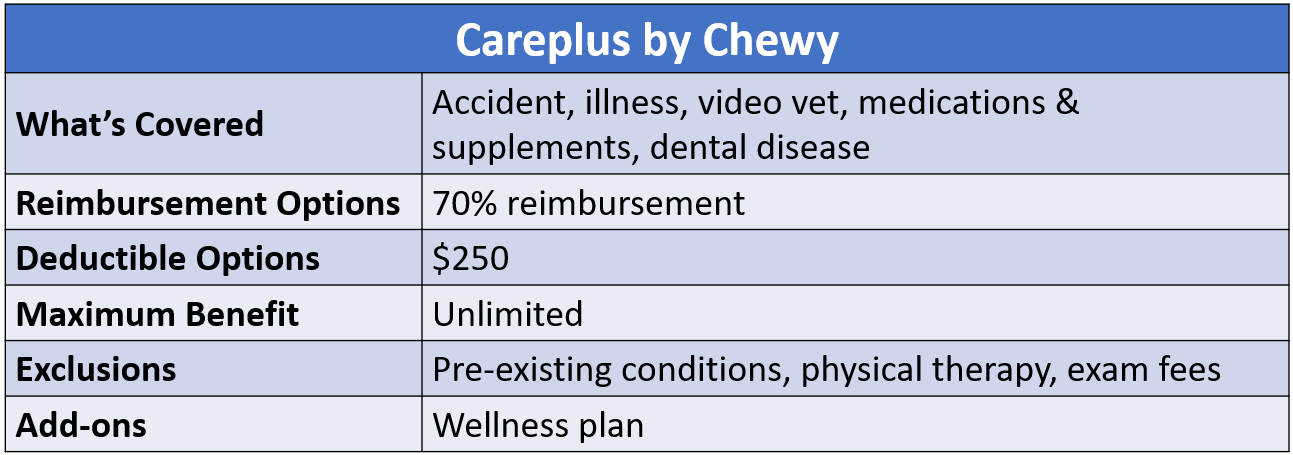

#7. CarePlus by Chewy

Chewy’s pet insurance for Australian Retrievers, called Careplus, is provided by Trupanion, which is another company on our list. You’ll find a few differences between the plans, with cost being one of them. Chewy’s plans are more expensive, and the reimbursement is only 70%. So, while I love Chewy for its pet products, and they’re a trusted name in the industry, I’d recommend going through Trupanion directly for insurance coverage.

The Careplus waiting periods are five days for accidents, 14 days for illness, and 30 days for cruciate ligament injuries (which commonly cause hip and knee issues).

One add-on offered through Chewy that you can’t get through Trupanion is a wellness plan, which covers checkups, heartworm/flea medications, vaccines, and routine testing. If this coverage is something you’re looking for, I highly recommend Chewy!

Positives:

- Chewy is well-known and trusted among many pet owners.

- Their wellness coverage offers reimbursement for some of the most common medical expenses.

Negatives:

- PRICE – Even more expensive than Trupanion, which is the company that provides their coverage.

Are you looking for other pet products for your dog? Check out these guides!

What pet insurance companies do you recommend for your Australian Retriever?

Let us know what you liked or didn’t like in the comments!